GIBRALTAR OFFSHORE COMPANY INCORPORATION

- Home

- offshore company

- GIBRALTAR OFFSHORE COMPANY INCORPORATION

Establishing an offshore company in

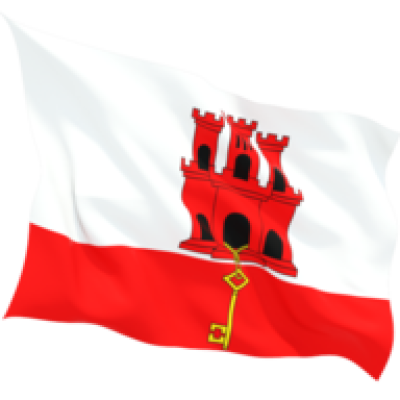

Gibraltar

ESTABLISHING AN OFFSHORE COMPANY IN GIBRALTAR

Creating an offshore company in Gibraltar presents an attractive option due to its favorable tax regime. By establishing a company in this territory, businesses can benefit from favorable tax conditions without the need to conduct economic or commercial activities within Gibraltar itself.

However, if activities are carried out within the territory and income is generated in Gibraltar, companies become subject to a 10% tax. This fiscal aspect of Gibraltar offers a significant advantage compared to EU countries, where VAT and other administrative procedures can pose challenges for businesses.

As the only British offshore center situated within the European Union, Gibraltar holds a unique position.

Financial institutions based in Gibraltar have the opportunity to leverage European passporting rights, enabling them to operate across the European Union without additional regulatory obligations in each country.

Establishing a company in Gibraltar has emerged as a preferred choice, especially in the casino and online gaming sector, where over 12% of the local workforce is employed.

Gibraltar

Gibraltar, nestled within the European Union yet close to Africa geographically, stands as a low-tax jurisdiction exempt from VAT. Notably, it imposes no capital gains tax, inheritance tax, wealth tax, estate duty, gift tax, or other capital levies. Bolstered by an international airport and robust road and maritime infrastructure connecting Europe and Africa, Gibraltar provides an ideal setting for global business endeavors.

This jurisdiction attracts a diverse clientele, including international executives, authors, athletes, corporations, individuals, families, and other entities pursuing their financial and business aspirations. They appreciate the significance of tax and estate planning and prioritize safeguarding their assets against unforeseen circumstances.

Gibraltar’s clientele spans the globe, with business and investment interests extending worldwide and managed centrally from Gibraltar. The jurisdiction offers bespoke company formation and management services at competitive professional rates. Gibraltar fiduciary firms excel in establishing and administering both simple and intricate corporate and trust structures across various jurisdictions on a day-to-day basis.